FMM asks govt to prioritise economic recovery welcomes GST reinstatement. If the employee count is less than 10 that is 1 to 9 then the employer has an option to register and pay at 05 rate of HRD levy in Malaysia.

How To Register Gst Gst Registration Online Step By Step Procedure

Liberalisation of the Services Sector in Malaysia.

. What is GST how it works. More 65 01072020 Guide on Transmission and Distribution of Electricity Services. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

COMPLAINT. Alternatively you can log in using. GST Plus Track everything in GST.

Financial transactions can also be managed using our detailed reporting modules. AGENCY Browse other government agencies and NGOs websites from the list. Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income.

You need to keep the tax invoice for your GST records. COMPLAINT. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia.

If your store is located in Malaysia then as of October 2021 you are charged the Sales and Service Tax SST on your Shopify fees. Taxable and non-taxable sales. GST stands for Goods and Services Tax.

Travel Boutique Online offers an interactive online booking interface to travel agents and tour operators allowing them to book travel products like Hotels Flights Travel Insurance Transfers Sightseeing and Holiday Packages and IRCTC simply and quickly. More 64 04072020 Import Duty and Sales Tax Exemption on KN95 Type Face Mask. Approved Major Exporter Scheme AMES Register Now More 67.

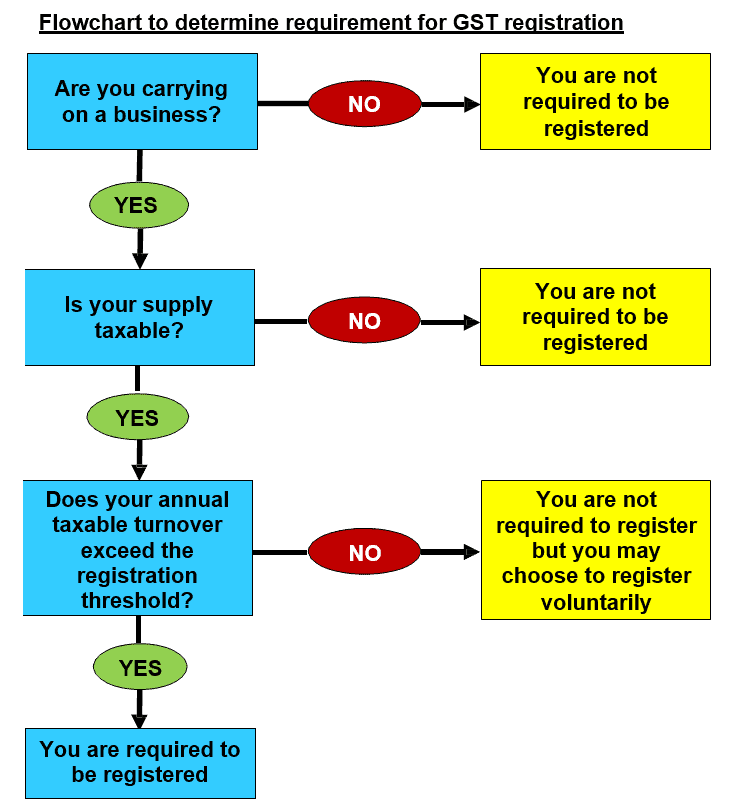

The net result is that minimum amount of GST payable in a tax period is the amount of reverse charge in that period. Its necessary to register GST for businesses having a gross turnaround of about A75000 or more. By updating your GST number with Amazon as a Business customer you can explore lakhs of products with GST Invoices offered by Business sellers.

But interest 18 on shortfall amount. GST Calculator Australia is a free online tool that helps you to add or subtract the Goods and Services Tax rates to any amount. Pay the correct GST and get a refund of the wrong type of GST paid earlier.

If the employee count is equal to or more then 10 then the employer of the company must register and pay 1 rate of workers wages. Selling goods or services. Following are the two eligibility criteria for HRDF levy in Malaysia.

After winning the toss and choosing to bat Canada got off to a flyer. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. GST to your Shopify bill.

An Expatriate Guide to Starting a Business in Malaysia as Foreigner. ITC will be reversed if not paid within 6 months. The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements.

Services Tax GST system as it relates to Singapore companies definition of GST registration requirements advantages and disadvantages of GST registration filing GST returns and schemes to. Penalty for delay in payment of invoice. GST Guide On Declaration And Adjustment After 1st September 2018.

Those minister staying in Ivory tower earnings pay beyond the comoners will never or refuse to understand how this upcoming gst hike during an pandamic war and potential economy crisis will affect the commoners. Foreign Company Setup Options. GSTR 20131 Goods and services tax.

More 66 30062020 NEWS 11. When you buy supplies worth 50 or less its still a good idea to get a receipt. Equity Policy in the Manufacturing Sector.

If you want to claim the GST on these purchases you will need a record of the. You should issue tax invoices when you sell goods or services. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

GST berupaya kukuhkan semula ekonomi negara. What benefits do I get if I update my GST number with Amazon. However if you register for New Zealand GST and add your Inland Revenue Department IRD number to your Shopify store then Shopify doesnt collect GST on.

This page is also available in. Penalty for wrongfully charging GST rate charging. EVENT CALENDAR Check out whats happening.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Penalty for incorrect filing of GST return. Indias largest network for finance professionals.

John can claim a GST credit of 100 on his activity statement. An Individual will be. Once GSTR 1 is filed invoices are sent to registered email ids captured from SSR AI GST portal and also uploaded on AI portal for download upto one year from the date of invoice.

EVENT CALENDAR Check out whats happening. The person making advance payment has to pay tax on. Other services you will find in the interface.

It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the supply of certain goods and services in India. Commonly Faced Problems by Foreigner When Doing Business in. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

You can file the GST Invoices for returns through GST portal and claim input tax credit on your business purchases. No penalty as such. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Email Your Username Password. Key Considerations Before a Foreigner Starts a Business in Malaysia. Saad bin Zafars 5-fer downs Malaysia Figures of 5-31 from left-arm spinner Saad bin Zafar helped bowl Malaysia out for 118 in a chase of 240 as Canada notched up another victory in Group A of the ICC Mens Cricket World Cup Challenge League.

Critical to develop foreign worker recruitment policy and system - FMM. Tax invoices sets out the information requirements for a tax invoice in more detail. Malaysia perlu bangunkan dasar sistem ambil pekerja asing.

For non-profit organizations its A150000 per year or more. Advance paid for reverse charge supplies is also leviable to GST. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

FMM asks govt to prioritise economic recovery welcomes GST come-back. This guide provides an overview of the key concepts of Singapores Goods. Melayu Malay 简体中文 Chinese Simplified Malaysia Financial Reporting Standards.

AGENCY Browse other government agencies and NGOs websites from the list. Uploading of ticket details is not mandatory. Also the amount of GST under Reverse charge is to be paid in cash only and can not be paid from ITC available.

John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. SST charged in Malaysia. It is requested to register on AI GST portal and upload ticket details within due date to get the invoices.

Malaysia Sst Sales And Service Tax A Complete Guide

Look What I Found On Aliexpress Kids Grocery Store Supermarket Design Cash Register

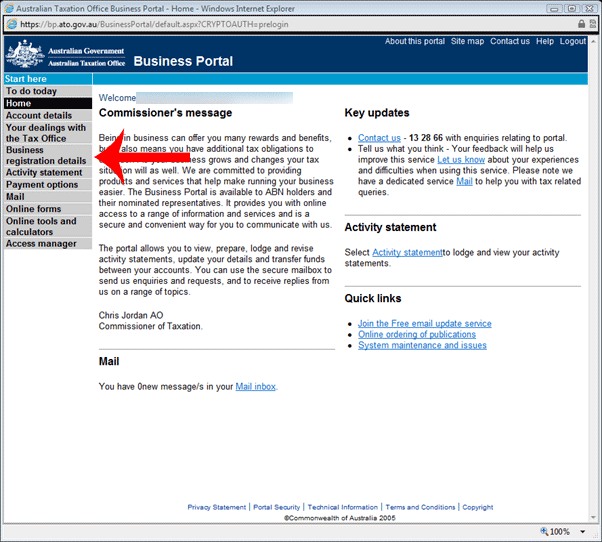

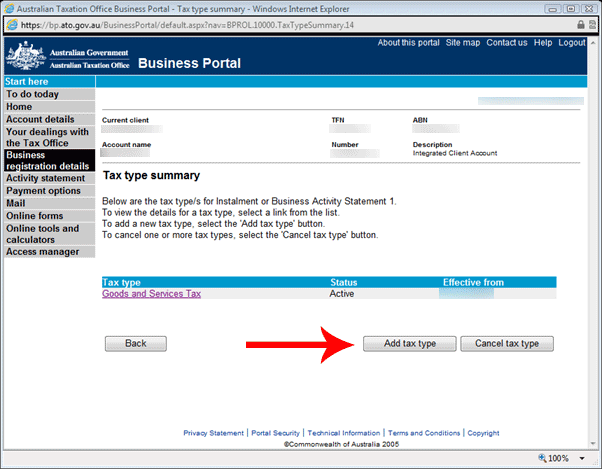

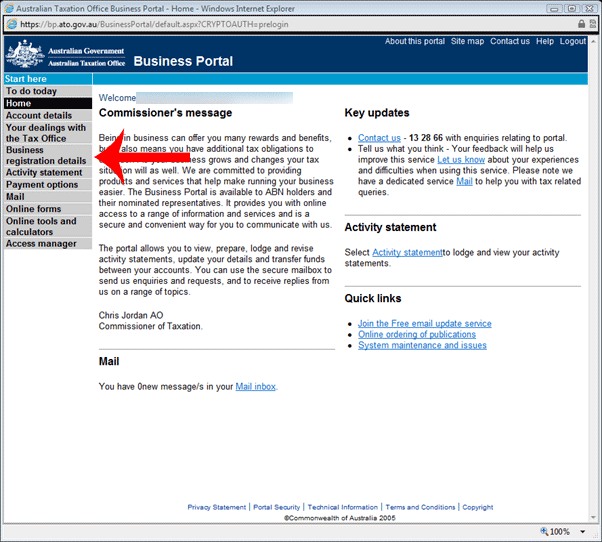

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Pin By Uncle Lim On G Newspaper Ads Ads Corporate Design

Restaurant Pos Software Restaurant Management System Bar Pos

Point Of Sales System Malaysia Online Pos Software Cashier Machine Restaurant Pos Pos Terminal Cash Register Sql Accounting Sst Tax Invoice Simple Pos

I Want To Start A New Business On Online Platforms I Require To Apply For Gst How Shall I Get Gst Number Quora

Registering For Gst Video Guide Youtube

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

How To Register For Gst If You Already Have An Abn In Australia Hard Answers

How To Register For Gst Gst Bas Guide Xero Au

Gst Registration Pan India Registration

Gst Registration Online Process Documents Fees Threshold

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Online Sole Proprietorship Registration In India

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling